We’ve heard a lot about financial institutions integrating transaction data into consumer lending, but what about small business lending?

We sat down with a small business data expert, Keren Moynihan to learn more about the latest insights.

Q: How would you describe the services and value that Boss Insights provides to financial institutions?

Boss Insights provides global leading access to business customers’ financial data … in minutes. We have a single connection to accounting, commerce, payroll, tax and more (i.e. Quickbooks, Stripe, SalesForce, etc.). Fintechs, private lenders and traditional lenders, including small businesses, use our platform. Here’s our One Pager, Case Studies, and Portal Demo.

We have two main products:

- Accounting, banking commerce, payroll, tax data & more (portal or API)

- Portals to originate, decision & monitor your business customers’ needs

Q: How would you describe the current state of the SME finance sector in North America?

SMBs have been underserved. Here’s why: Lending runs on percentages. Typically, the larger the business, the larger the loan and vice versa. Therefore, service providers have to serve SMBs and commercial businesses with less resources – and that’s because they learn less on the loan the smaller it is. The same is true for any funding facility (be it from credit cards, funding, loans, etc.).

Now let’s talk about what businesses need and – thanks to the latest advances in industry, what they expect. First, they need access to capital. Second, they expect personalized and instant service.

Fintechs, private lenders and traditional financial institutions are experts on their offerings. Moreover, the struggle is how to access data and provide instant and personalized service in a world where speed is paramount.

Accessing businesses’ real-time financial data is key to serving business customers. Today, the manual gathering makes it costly and time-consuming. To be competitive, fintechs, private lenders and financial institutions must offer immediate service to business customers, tailored to meet their goals. Why now? Because empowering fintechs and financial institutions to serve SMBs is long overdue.

Q: Can you give an example of how fintechs & financial institutions use your data, such as for a lending decision?

Of course! The first thing we do is learn about the process that fintechs or FIs have in place. Are they running traditional loans that require banking statements or financial statements? Are they offering alternative financing or credit cards that require sales information coming from commerce? And are they offering a payments platform that requires the platform for business users and the service provider?

We then offer the platform and the access to the information with a same day set up. The move from PDF and paper statements to visualized, real-time, digital information on dashboards is really exciting.

A few case studies published showing how fintechs and FI’s (Financial Institutions) have competed using this. The results show a 36% increase in decisions, 5x faster monitoring (500%!) and as much as 60% less resources.

Q: Are additional skill sets needed, in order to effectively use your data? Or is it more of the traditional analytics, product and lending skills that are needed?

Our platforms are for any user that is offering products to market (lending, payments, funding, credit cards). Some would like their own portals and they can gather information by API – if they have developers.

Q: When you work with financial institutions, what do you notice are the biggest challenges they face in terms of adopting these new data sources?

Identifying what they want to do and having the decision making capability to move forward.

Q: What is the most surprising or unusual use case you’ve seen with your data? What is the most common?

It is becoming more common to have all the information required in one place. The most unusual has been social media.

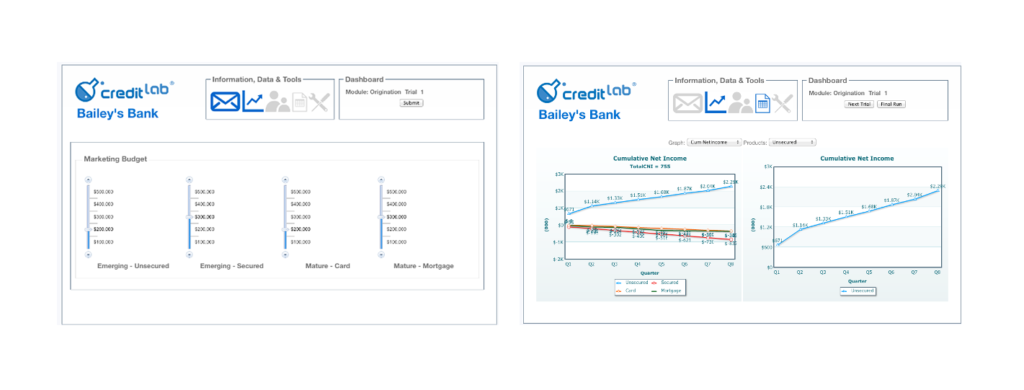

Insights from our CreditLab Simulation

Q: At BankersLab we run hands-on simulation workshops to teach lenders how to use data such as yours. What do you think might be some key learning insights which would empower them?

So much to say! In one panel, I asked bankers how many had been given a mandate to digitize without any other particulars? Most bankers raised their hands. I’d start by learning about their challenges and helping to reframe them into opportunities for technological advancement.