Hype vs. Reality: There is a lot of hype these days about open banking data, but what’s the reality?

Are lenders successfully integrating these new data sources?

To find out more, BankersLab spoke with Amanda Relton, an Open Banking Expert to learn more about live use cases in the industry.

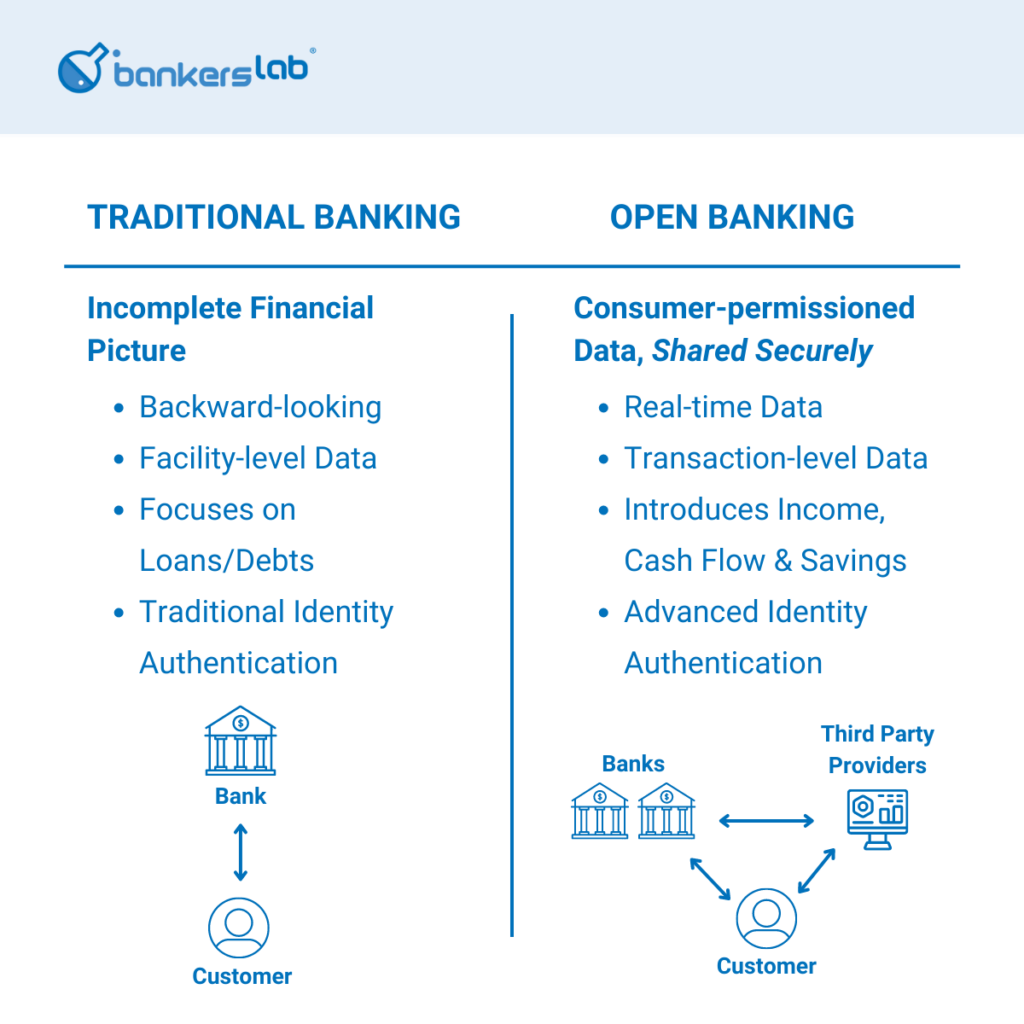

First a few quick definitions:

- Open banking refers to the practice of sharing financial data securely.

- Open banking data refers to banking transactions, or cash flow data which is shared via this process. Note that with the advent of customer permissioning, your market may have open banking data prior to there being an “open banking” regulatory regime.

- Alternative data refers to non-bank data such as rental payments, utility payments, etc.

____________________________________________________________

____________________________________________________________

Examples of how lenders are using open banking data include:

- Streamlined Application Processes (income proof is furnished via the open banking data)

- Comprehensive Financial Analysis (cash flow and spending patterns, for example)

- Real-Time Data Verification (income, employment, etc)

- Enhanced Risk Assessment (savings and investment patterns)

- Tailored Loan Products (personalized interest rates and loan amounts)

BankersLab: Amanda, can you describe some of the work that you’ve done with open banking data?

Amanda: Most of the work I’ve done with open banking data has been in financial services, particularly lending – that is definitely my area of expertise and also the area I think open banking can provide maximum impact. Think mortgages, personal loans, auto and even business lending. I’ve seen a number of business problems solved including regulation, automation and improving current processes which are time consuming and resource intensive.

Most of the businesses I’ve worked with have similar goals:

- to improve their customer’s experience;

- satisfy compliance requirements;

- improve conversion rates;

- win over customers more quickly;

- increase their market share; and

- save on costs by automating manual processes.

BankersLab: Can you think of a use case that has had a lot of hype, but hasn’t really had an impact yet?

Amanda: One of the most talked about use cases is open banking data for PFM (Personal Financial Management). This is when open banking data is used to develop applications or services that help individuals manage their personal finances. By accessing transaction data from various accounts, users can get a holistic view of their spending, budgeting, and savings patterns, enabling them to make more informed financial decisions.

PFM is a great use case but also one that is difficult, in my experience, to commercialize. Users often expect PFM services to be free or offered at a minimal cost and many individuals are accustomed to accessing basic financial management tools without direct charges so the justification of additional value or features that require a price tag need to be very, very clear.

BankersLab: Which lending use cases have you seen, in reality, that have had some of the biggest impacts?

Amanda: First, Account Aggregation. Who wouldn’t want to see all of their accounts in one place and get a full view! But I think this is one that was commoditised quite quickly.

Second is Affordability. The value of automating the collection of bank transaction data is clear and in an open banking world, financial institutions are learning to replace paper-based capture with electronic data. Open Banking is a very strategic solution to make quicker and more accurate business decisions. I am seeing a world where bank transaction data will soon be used as the default option for all credit decisioning – income, expenses and affordability.

Third is assisting collections departments and customers in hardship. For example, collectors might spend 15-20 minutes during a call with a delinquent borrower trying to understand the customer’s expenditure and financial position. Open banking can help assessors do an immediate financial evaluation on the customer, and with appropriate consent, they can also continue to monitor their expenditure and income streams and then act on that information. Call times are substantially reduced allowing accurate data to be used for shorter, more informed discussions with customers – mitigating the need for repeat calls and ultimately less stress for the customer.

BankersLab: How would you suggest lenders get started with Open Banking Data?

Amanda: Working with financial data is difficult. Some ways to prepare for open banking include:

- Get accustomed to working with transaction data

- Understand how you can leverage the data to improve credit assessments

- Offer personalized loan products

- Streamline processes

- Enhance the overall customer experience.

A “live” use case in the industry is to observe that a person is spending at a certain retailer, notice their average spending at a certain outlet, noting that this person has a direct debit arrangement, and if so, notice if they are failing a direct debit. The possibilities are literally endless. This granular data can be converted to a discrete, summarized value in order to answer specific questions about that borrower.

BankersLab: What type of mistakes have you seen lenders make, when embarking upon their open banking journey?

Amanda: The biggest mistake is not investing in the best possible customer experience. Customer consent is a complex and crucial part of accessing open banking data. The consent experience for customers is paramount to the success of the onboarding process. If it’s too slow or feels clunky, customers will drop-off.

Lenders must create consent for:

- Initial onboarding

- Connecting to institutions

- Managing consent items including expiry, permission to continue to connect to institutions, and deleting connections.

Pro Tip: Fortunately there are many vendors who do this really well, which will save you time that can be better spent on your business.

BankersLab: What have you noticed as the biggest enablers of success at lenders who have been able to successfully leverage open banking data?

Amanda: Being really mindful of the services you need and the outcomes you want to achieve. It’s imperative to choose the right approach for your business and if you choose to partner, choose a partnering provider that truly understands your business needs and offers a wide coverage of financial institutions, data quality, security, connection stability and speed.

BankersLab: Let’s summarize the hype vs. reality!

Use cases with Hype:

- Personal Financial Management, because it is difficult to commercialize.

Use cases yielding results in Reality:

- Account Aggregation. Endless possibilities to integrate summary variables into your decisions.

- Affordability. Automate your assessment of income and expenses, which was difficult and manual in the past.

- Collections and Hardship. Give your collectors ‘superpowers’ to assess and counsel your borrowers.

In order to achieve success with these use cases, remember to invest in the customer experience. This is a mandatory step which ‘unlocks’ the open banking data permissions!

What use cases will you try?