Dear Gini,

I am new to risk management and feeling a bit overwhelmed (my background in operations research and statistics). I am hoping you can help me with a better understanding of bank policies, credit policies, rules, strategies, credit scores and how to fit together these important pieces?

Johnny Newcomer

—————-

Welcome Mr. Newcomer,

Good news! We exist for people just like you. Many incoming staff members may have good backgrounds in math but are new to risk management or consumer lending in general. For starters, know that your background will serve you well as you master your new responsibilities. Now let me set the stage…

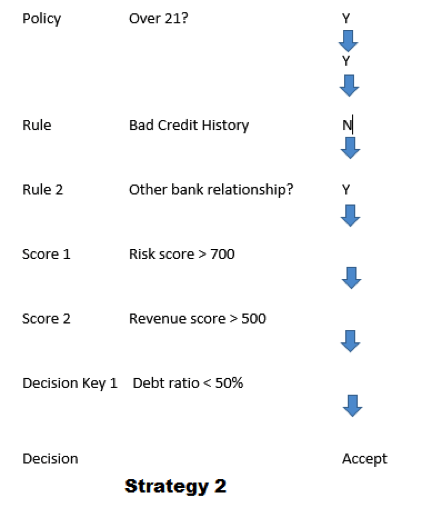

A strategy is comprised of various decision elements such as decision keys, credit policies, business rules or scores. Scores in turn can can be models that predict various outcomes like risk, revenue, or the propensity to respond to a promotion; in all cases – a prediction. Multiple scores can be used in a given strategy. Credit policies are things like “We do not approve former bankrupts”, or “We do not lend more than 80% of the value of collateral”. Most credit policies are hard rules (i.e. no exceptions). Business rules are used to set reasonable boundaries like debt ratio ranges, or breaks before using another decision element to refine the test. Put together, all of these elements define a credit strategy.

A strategy can be as simple as “if score > 750 approve, otherwise decline”. Good, bad, or indifferent – it is still a strategy. Is it any better than the example in figure 1 (Strategy 2)? That is a hypothesis that can be tested. Indeed, the two strategies can be tested in a live (or simulated) environment to see which performs better (bottom line measures). In a strategy, elements can be more than just binary rules. Score for example, can be broken into 5 or 10 ranges, as well as revenue score and debt ratio. All of which would lead to a large number of end nodes, each having a more complex action (approve with a line of $x), but for the example we are using a Yes/No split and a single outcome.

A strategy can be as simple as “if score > 750 approve, otherwise decline”. Good, bad, or indifferent – it is still a strategy. Is it any better than the example in figure 1 (Strategy 2)? That is a hypothesis that can be tested. Indeed, the two strategies can be tested in a live (or simulated) environment to see which performs better (bottom line measures). In a strategy, elements can be more than just binary rules. Score for example, can be broken into 5 or 10 ranges, as well as revenue score and debt ratio. All of which would lead to a large number of end nodes, each having a more complex action (approve with a line of $x), but for the example we are using a Yes/No split and a single outcome.

Now this is meant to be a simple example of what a strategy might look like using a combination of policies, rules and scores. The question is: Is it better that the first strategy? Clearly it is more complex than “if score > 750 approve”, but is it better? Does it produce a better result? Does it improve the bottom line? Let’s say it does, the next question is: Is there an even better strategy that could further improve your results?

Welcome to your new world – and ours too! What we do is help risk managers refine their skills at strategy design, evaluate results, and refine their strategies. For more information, have a look at our courses to learn more!

Good luck,

Gini

Ask Gini Terms

Content provided in this blog is for entertainment purposes only. Ask Gini blogs do not reflect the opinion of BankersLab. BankersLab makes no representations as to the accuracy or completeness of information in this blog. BankersLab is not liable for any errors or omissions in this information nor for the availability of this information. These terms and conditions of use are subject to change at anytime and without notice.