Dear Gini,

During a recent credit policy review, management asked us why we weren’t making greater use of debt-to-income analysis. Outside of some broad policy criteria, such as debt ratio under 50 percent, we don’t have anything analytic. What ideas do you have?

50 Percent

——————————————-

Dear 50 Percent (cool rapper name),

Debt-to-income analysis doesn’t always include all of the information. Along with the analysis, there are three critical things we need to consider.

- Data

How good is the data upon which you’re basing your debt ratio calculation? Are you using the debts provided by the applicant? Are you using the debts listed on the applicant’s credit bureau report? Or are you using a combination of both? My advice is to use the debts listed in the credit bureau report because it is common that applicants may forget about some of their debts and you don’t get a complete picture for your debt-to-income calculation.

- Obligations

Do you really understand the debts for which your applicant is responsible? Does your list of obligations include items not included on bureau reports, such as alimony, insurance premiums, or expense of caring for an elderly relative? What do you know for sure?

The answer to any one of these individual questions isn’t enough. You need the answers to all of them to get a true picture of your applicant’s monthly obligations. It’s like trying to figure out the meaning in a rap song just by listening, it doesn’t make sense until you actually read all of the words (but even then, with some rap songs you may never get the meaning).

But back to the subject at hand. Some of these obligations that don’t show up on a credit bureau report are the items that get paid first each month – like the monthly payment to the nursing home where the applicant’s mother lives.

- Income

Like obligations, how much do you really know about your applicant’s income? You’ve probably encountered people who have a debt ratio of 100 percent yet pay their bills every month. What income sources are they forgetting or hiding from you (and the government)? On the other hand, you’ve also probably encountered applicants with a 20 percent debt ratio who go bankrupt. What’s that all about? See the Obligations section above to help answer that one.

But back to our discussion on income. You know what your credit seeker has put on their application, but still ask for additional sources of income. You might find out that they make and sell crafts, or moonlight as an Uber driver, or pose as a rap star (50 Percent) and sell their music. The point is, keep in mind that the more income revealed the more likely the loan you’re originating will get approved.

Summary

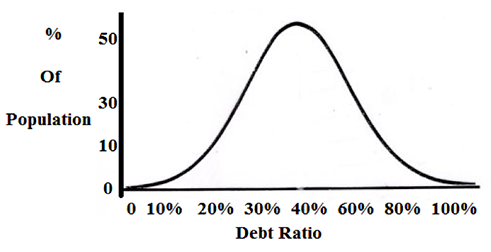

I’ve seen cases where error rates on debt-to-income calculations exceeded 40 percent (both higher and lower) once bankers took the time to dig deeper into the data, obligations, and income we just discussed. Consider the fact that most people fit within a fairly narrow band of debt-to-income ratios of 30 to 60 percent, and now you see why it’s critical to go beyond debt-to-income analysis and dig deeper.

Good luck,

Gini

Ask Gini Terms

Content provided in this blog is for entertainment purposes only. Ask Gini blogs do not reflect the opinion of BankersLab. BankersLab makes no representations as to the accuracy or completeness of information in this blog. BankersLab is not liable for any errors or omissions in this information nor for the availability of this information. These terms and conditions of use are subject to change at anytime and without notice.