Interview with André Gregori at Octane Lending, a US FinTech

We’ve noticed an emerging trend of engineers and technical staff joining our simulation workshops. What’s the value of managing their own virtual portfolios if it’s not their ‘day job’?

We asked the Technical Co-Founder of a rapidly growing US Fintech. In the innovation space, we’ve learned from Agile that we must drive strong cross-functional collaboration. It seems that Octane is really putting this into practice.

BL: Please describe your role at Octane.

André: I am a co-founder and VP of Product at Octane. We provide instant financing for purchases that bring joy to our customers. Folks may know us as a key player in Powersports — i.e., the motorcycle, personal-watercraft, and side-by-side space. I am in charge of our point-of-sale technology products, which facilitate the purchasing and financing experience for merchants and their customers.

BL: For technologists, what benefits do you see for gaining more subject matter expertise in lending?

André: Lending is our revenue model and a core feature of our products. As a lender, whether you make or lose money is dependent on how well you mitigate risk, price your products, and understand and attract your customers. The design of a good financing experience —as well as of the underlying technology — requires product managers and engineers to develop a gut for the art and science of lending.

BL: Pulling folks out of their daily work to attend training doesn’t seem to fit in with the “move fast and break things” scaling narrative. What role does training play in the rapid scaling of Octane?

André: Training plays an absolutely pivotal role at Octane and it allows us to move faster and more confidently. We’ve found that we can scale more effectively by distributing our lending expertise to the groups that design and implement our products and technologies. An exclusively centralized understanding of lending is a bottleneck for a rapidly scaling organization.

BL: On a related note, what role does training play in developing a positive company culture?

André: Participants in a training program are asked to work together in new and different ways. This gives participants a venue for creating not only camaraderie, but an appreciation for the craft of other departments.

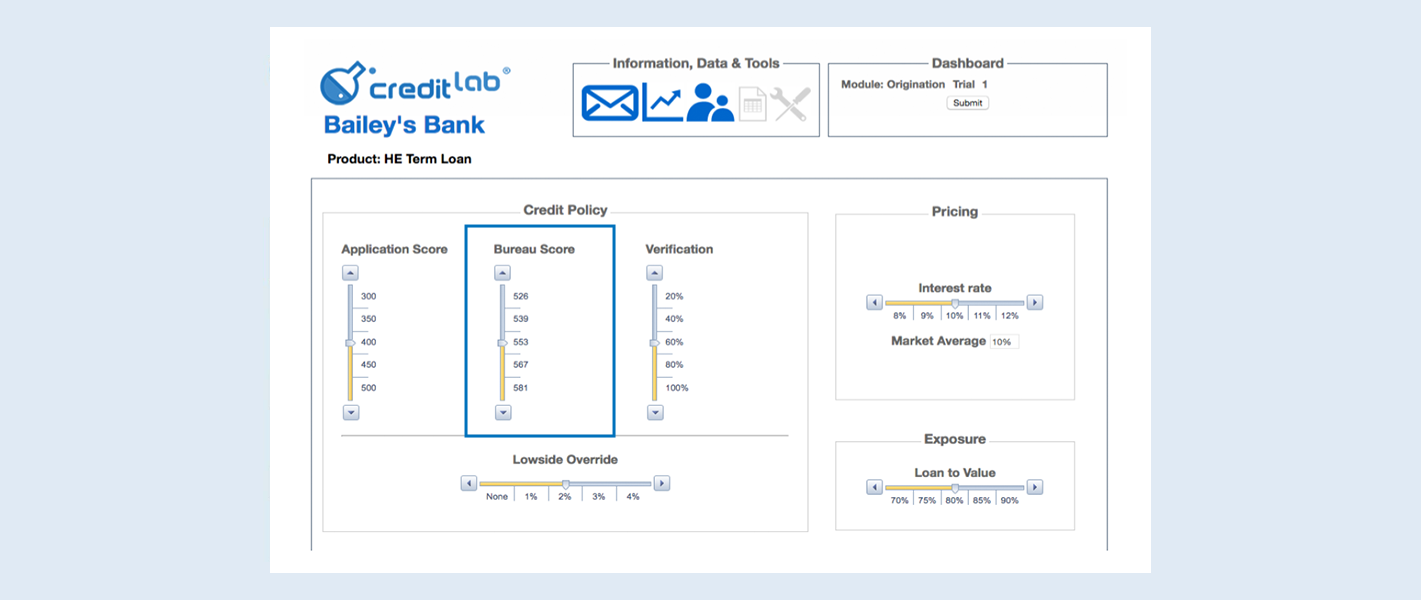

BL: For the recent simulation workshops, we configured the simulation to ‘look’ like the Octane portfolios. How did this play a role in the impact of the workshop?

André: The hands-on nature of the workshop was essential for participants to develop a feel for the practical aspects of lending in a safe environment. To truly learn, you cannot fear failure. A simulation is the best approximation you can get to real life without the palpable risk of damaging your business.

BL: Did you have any take-aways, or ah-hah moments from the simulation workshop that you can share?

André: I personally enjoyed how the program encouraged us to think outside of the more obvious levers of scorecards and credit score thresholds. Several approaches will impact your bottom line, including the dynamics of the market you choose to be in, how and how much you spend on marketing, what your collection tactics are, etc.

If you’d like to ‘game out’ your strategy with us in our simulation, drop us a note! in**@********ab.com