By Darryl D’Souza, CFE

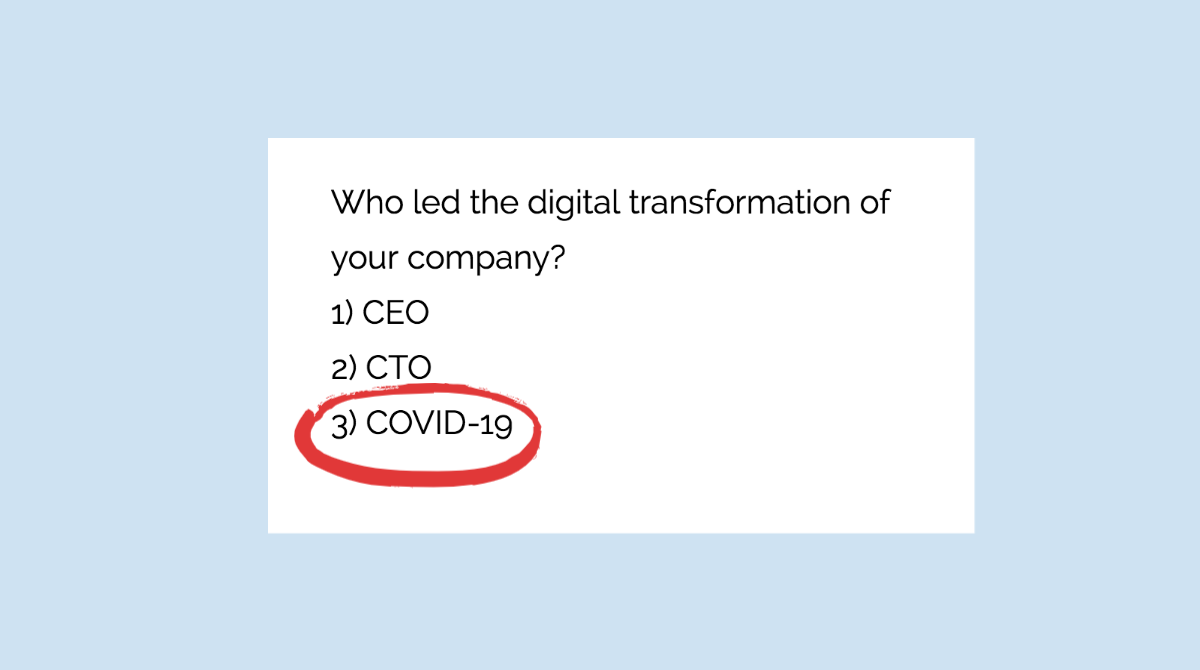

One widely-shared meme asks: “Who led the digital transformation at your company: the CEO, the CTO, or COVID-19?”

While the devastation of the pandemic is no joking matter, there is no denying that the rapid economic and social changes have caused the Collections industry to shift farther and faster than ever before, with practices once unthinkable becoming commonplace.

So what are we seeing in light of such a monumental shift in the way we do business? While there are many challenges, there are also some silver linings that offer promise for the future of the industry and our long-term financial wellbeing.

1) Different Strategies For Handling Bad Debt: In some markets in Middle Eastern countries, companies reduced salaries of their employees between 25% to 50%. Financial institutions were prudent and considerate, so with the help and funding from Central Banks they deferred payment of those customers that got a reduction in salaries by three months and then again another three months. Assuming this program started in April, the first three months would end in June and the second three months would end in September.

However, giving customers a six-month payment holiday is a challenge for the Risk Management teams (especially Collections) because over this extended period the customer has gotten used to not paying their installments. Starting in October, the Collectors will face a challenge in collecting and the accounts will flow from bucket to bucket, thereby increasing bad debts by December.

Instead, a better method would have been reducing the monthly installments by the percentage of reduction in salaries. This way the customer is treated fairly and banks continue to receive cash flow and the accounts do not age. At the same time, by reducing the installments proportionally rather than all at once, there is no risk of bad debts suddenly hitting banks at the end of the year.

2) Better Customer Satisfaction: Customers on the whole were more responsive to bank calls since they were working from home during the pandemic. The increased number of people working from home helped to improve contact rates for Collections. Additionally, work from home increased the disposable income of people who did not have a pay cut. People did not have to spend money on travelling to the office (transportation costs), dressing up (personal grooming, clothes) or on eating out, hence some had more disposable income. Because of these factors, payments increased towards debts and collections increased as a whole.

3) Increased Collector Productivity: The productivity of collectors increased while working from home since they worked from a relaxed environment and stress levels were decreased, this also helped significantly increase the dollars collected.

4) Greater Technological and Digital Channel Adoption: From a financial institution perspective, the customer adoption of digital channels increased significantly. This rapid adoption pushed banks to upgrade and invest in this channel.. Overall, the adoption rate of the digital channel by customers increased by over 50% across the Middle Eastern countries.

5) Increased Employee Productivity: Most financial institutions are rethinking their strategies on brick and mortar operations to remote working (work from home) since this mode is cost-effective and efficient. Productivity of employees increased by 75% and the time spent by employees on office work from home went up by at least 30%.

6) Fully Online Training: Webex training is the new normal and large financial institutions have already started planning on future training to be delivered remotely. This switch to online training reduces training costs significantly.

While some practices, such as six-month payment holidays should be reconsidered, by and large, the industry has stepped up to meet the moment. We’ve got a long and rocky road ahead, yet the Increased worker productivity, better customer satisfaction, and skyrocketing digital adoption offer a promising way forward.

Information courtesy Darryl Brian D’Souza (CFE), Board Director, Head of Credit and Collections, Author ‘The Art of Quality Debt Collections’

![Some Silver Linings in MENA Collections during the Pandemic [With Infographic]](https://www.bankerslab.com/wp-content/uploads/on-demand-courses.jpg)