Microfinance is known as a path out of poverty that can also empower women. What’s the reality?

Microfinance is known as a path out of poverty that can also empower women. What’s the reality?

When visiting the northern reaches of West Bengal last April, I noticed that many of the women clients had borrowed the money to invest in their husband’s or their family business. For example, she might assist him in running a cycle repair shop, small retail business or work together in an agricultural undertaking. Typically the wife works alongside, with both family members playing a critical role. I noticed that the MFI loan life insurance only covers the borrower.

I asked a question. “What happens if the husband dies, and the wife cannot run the business on her own? How can she repay this loan? Is there any support for her?” At the time, the answer was “No”. I was concerned that while it appeared that so many were benefitting from these loans, a few borrowers might find themselves in a disastrous situation if saddled with a loan they cannot repay due to an untimely event.

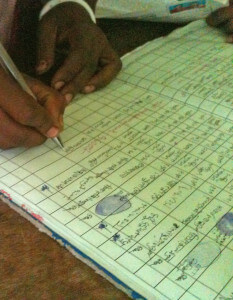

Society for Model Gram Bikash (GBK) took this question to heart. They worked with the insurance company to cover the co-borrower as well. During our visit last week, we were able to participate in loan disbursements where both wife and husband were covered. Now, the family is protected if something happened to either the wife or her husband.

It’s a small thing. It won’t change the world. But it will change the world for the borrower who finds herself in the midst of a tragedy. Her husband’s funeral will be paid, her loan forgiven, and she can pick up the pieces and work out the next steps needed to take care of her family.

The devil is in the details; even the smallest of changes can add up to make a big difference. BankersLab is proud to support Grameen Foundation Bankers without Borders who provide technical support and capacity building for Microfinance. Our aspiration is to help to make small changes which eventually add up.