Just to give you an idea the five FinTech trends we’re gonna cover are very focused on retail lending and wealth management so if you logged in today wanting to hear about blockchain and Bitcoin – you are in the wrong webinar.

We’re going to focus on consumer retail and lending wealth management all that customer-facing stuff that the banks are doing.

So you can see the five trends on your screen that we’re going to cover, but I don’t just want to cover them in isolation.

That’s because of the key points of these five trends which are:

- E-KYC,

- Mobile-First

- Big Data

- Machine Learning and AI

- Cross-Vertical Integration

And they are even more interesting (and useful!) when they’re integrated together.

Let’s go back to an example use case, and let’s say I want to go on vacation. I have an Alexa in my house, which is a voice-activated device if you’re not familiar. What I wish I could do is just say, “Alexa I want to go on vacation now. “

At the moment if I want to go on vacation I would have to log into a travel planning website like Travelocity and Kayak, I would look at the reviews. Now I’m currently in Singapore so I try to figure out what direct flights are available because I don’t want to make a connection.

Then I’d remember, “Oh I have some miles on Emirates and Thai Airways and Singapore

Airlines – so which one do I have enough to go to a place I want to visit?” So then I probably log into all those different accounts, check my points, the whole ordeal.

I don’t know about you guys, but in the past, I’ve actually kept this organized in a spreadsheet over the years to see so I can see at a glance what mileage I have!

Say I do have enough money to go on this vacation, so then I log into my DBS account. I might be using a personal financial management app such as Cuber, which I’m using to gamify my savings so I can save for that vacation. I’d have to log into that and see how much money I’ve saved and how long it’ll take me to save enough for the trip.

So if I really did this and wanted to optimize this myself it’d probably take me a whole weekend of work to work it all out – and then I really need a vacation!

Now that we’re done figuring all that out, now we’re talking about retail and consumer lending, but at the end of the day, you have to think about your customer.

Your customers, they don’t really care about banking, they just want to go on vacation, they want to save money, they want to buy a house, they have all those kinds of goals. So when you can connect with your customer at that level it’s a game-changer for you.

So think about the future state and this is not far away. This is not really that futuristic, to have a use case where soon I’ll be able to go home from work, walk into my house, and say, “Alexa I want to go on vacation,” and then using machine learning and artificial intelligence she will pull together all of those data sources on my preferences where have I traveled in the past.

And I can tell her things like:

- I want to only nonstop flights

- How many days I’ll take off (so she might be able to check my work calendar so see which days I’m free

- And because of integration, she’ll already know how much money I’ve been saving

And so with all this, she’ll say, “Well, I have three options for you Michelle – you haven’t been saving enough so you’re gonna just have to go to Phuket and use your free Hotel points and stay there for three days, and that’s all you can do, or Option Two if you wait a couple of months and you save a bit more maybe you can go to Bali.”

So that’s the kind of use case and you can imagine the type of machine learning that’s required for this kind of use case. So keep that in your mind as we go through these trends because if we go to the next page and see the trends, in my view they’re not that interesting in isolation. I mean they sound cool and they’re buzzwords, but as a customer of a bank I don’t really care, I just want to go on vacation.

So for each of those five trends you just saw we’re gonna cover four topics.

I’m gonna just make sure you know

1) What it is

2) Give you example use cases from around the world

3) Highlight a few business and career implications you might want to keep in mind and

4) Then I’ll give you a few suggestions about what you can do in your own life, both in your career your learning at your job to leverage the trend

Let’s start with E-KYC, which is the electronic process in which a business identifies and verifies the identity of its clients.

E-KYC procedures must have the same standards as the KYC procedures usually conducted where the relationship is established face-to-face, and some examples of E-KYC currently used include Biometrics (facial recognition), voice control (Siri, Google Home), and Finger Prints.

E-KYC is really important because none of the stuff above happens until you know your customer. They have to authenticate, they have to login, etc, and so even with the above example with Alexa, I need to be authenticated to all of those accounts and have authenticated my bank account so it can access my data.

So the magic of the new E-KYC capabilities is that from the customer viewpoint I can just either use voice-activated facial recognition or a fingerprint to be authenticated to those multiple data sources. So that’s a critical enabler here, none of this works without the E-KYC stuff, so you just have to be mindful of that and really make sure that you’re adopting that at the right pace so that you can kind of get to where you want to be, okay?

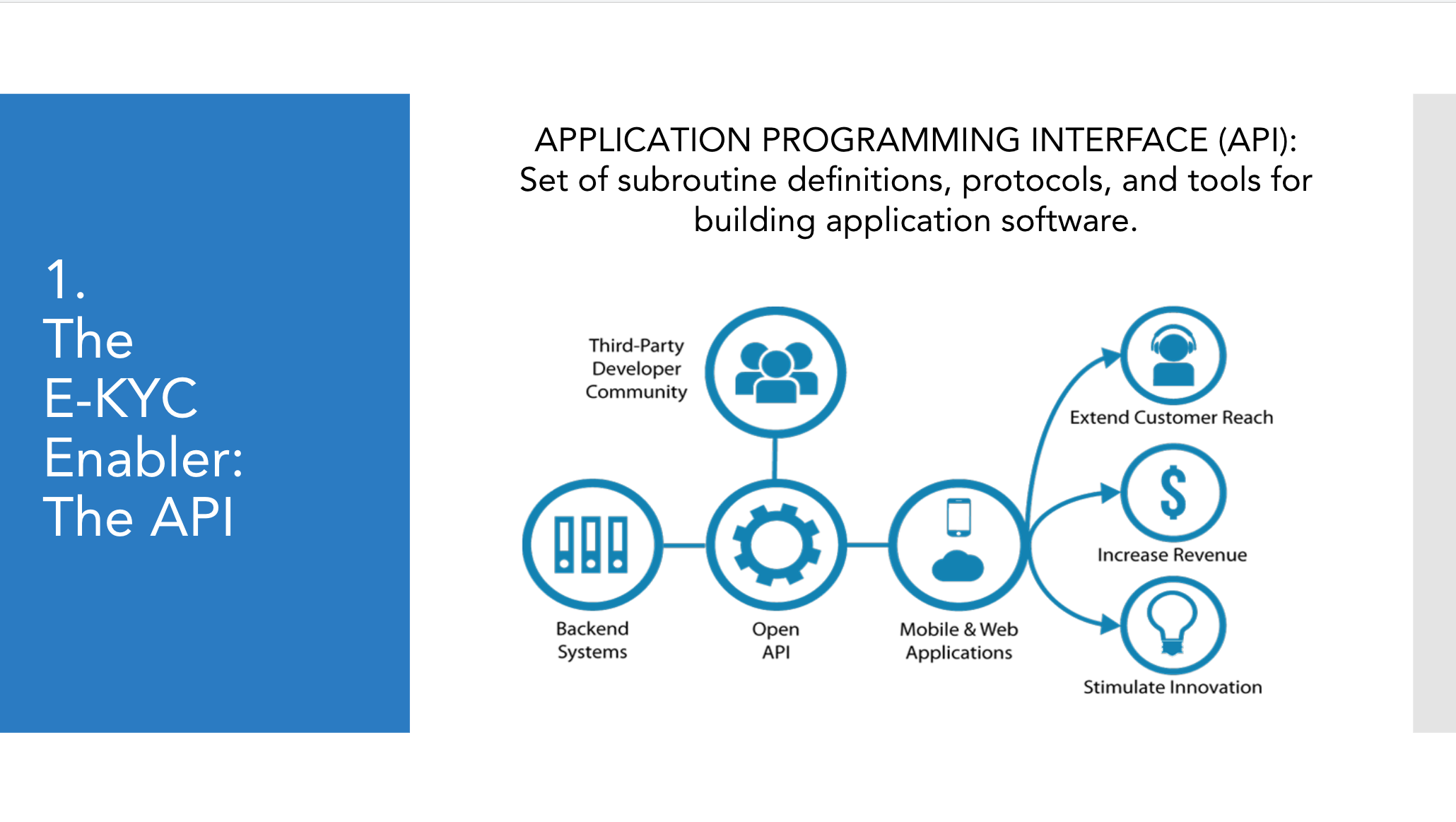

Aside from those biometrics, those of you who are in India will be quite familiar with the other system that you guys have, but the other enabler for E-KYC is called an API. If you’re not familiar with API, or application programming interface, this is essential to how E-KYC works. So I’ll give you a really silly example of an API, if you’ve ever been at Starbucks or a coffee shop and you want to login into their Wi-Fi it says you can login with Facebook and that’s because Facebook has an open API, which is what you see there as the gear wheel.

So you’re sitting in Starbucks and you are able to use that an open API which allows your device to authenticate through Facebook, which you’ve already authenticated before, and the backend systems are all of the Facebook data. So the important thing to think about which relates to the next part of this presentation is that whatever public Facebook data that you have is now provided to Starbucks as part of that API authentication.

That’s something to keep in mind that it’s important because you have to get the data from A to B, so it’s kind of a basic thing to know.

I don’t mean to disparage an API but it is kind of the plumbing it moves the data so let me give you some E-KYC use cases, which are really important. Capital One is a bank is in the US and they already have an Alexa API so it’s an open API provided by the Alexa tech folks and you can authenticate your Capital One credit card.

So when you walk in the house you can just say, “Alexa pay my credit card bill,” so that’s an example of the power of the biometrics the API working together for the customer experience. If you’ve used Apple pay, you should be quite familiar with being able to log in using just your fingerprint.

I’ll give you a personal example of mine, and it is kind of a good and bad example at the same time.

I’m a customer of DBS here in Singapore who’s one of our more advanced technology banks and the interesting thing is that they have a mobile banking app of course. While I could use their website, the interesting thing is that it is actually much easier to use the mobile app than the website and especially for approving transactions.

So what we figured out, and our customer service people actually gave us the hint, they’re like oh actually set up the payments on the website, but approve it from your phone because if you approve it on the website it requires several more steps. So for me, the key thing is on the phone I authenticate with my fingerprint on my phone pad to authenticate, whereas on the website I’m going to have to type in a whole series of numbers.

Right, so this is an example of where we see leap-frogging of the mobile applications moving forward because of that biometric capability. So here are some business and career implications:

1. Whenever you move to another technology you will introduce new technology risks

We need to be realistic about this, and the best way to approach that is to have an active bug bounty program, so in your company, if you’re launching these bounty programs, which means that you put out into the public sphere saying, “hey if anybody finds a bug, we’ll pay for it once we verify the bug,”.

This works really well because it kind of crowdsources people trying to find any holes in your system. There’s a link to a video here for you.

This video is really long, but if you’re not familiar if you’re not comfortable with technology if you’re not sure what API’s do, you have anxiety about bank security, this video is an amazing journey of a college student in Germany who was able to hack in one of the most famous digital-only banks in Europe and he walked through systematically what he did and where the failure points are. It’s actually quite funny to watch and entertaining but it’s also incredibly educational so these are the kind of things that you can watch to learn about these things.

2. You need to understand how APIs work fundamentally.

I mean you don’t need to be able to write them or be an expert, but for example on my team the person who handles our marketing function she’s not a technologist she’s not a programmer, but she is excellent at setting up a POS. She sets up API’s for example with a platform called Zapier, or you can use slack, and so for example if we enter and update into our CRM system it’s automatically zapped or sent by an API over to a side-channel so the team can see the entry whenever our server is down.

There’s an API that sends that in a message to slack so the whole team knows about it so it’s just like the basic functionality of how life works these days so it may seem a bit boring, but hopefully, you can you know have a little fun setting up stuff and testing it out to learn about it and of course, test out stuff for yourself test out all these different payment mechanisms for yourself and see how it works.

Keep track of all these new technologies, there are some great podcasts that you can listen to for those of you who have long commutes, I can suggest the London FinTech podcast, FinTech insider, which will keep you entertained during your commute and you can learn a lot about the latest technologies.

Want to learn about all five fintech trends? Stay tuned for Part II Mobile-First, Part III Big Data, Part IV Machine Learning and AI, and Part V Cross-Vertical Integration.

![[Part 1] Five Fintech Trends: The Electronic Know your Client (E-KYC) Process](https://www.bankerslab.com/wp-content/uploads/on-demand-courses.jpg)