We’ve always believed that the best way to learn portfolio management is through gamified simulation. For years, our workshops have let teams step into the role of a retail bank, making lending decisions and competing to maximize profits.

Whether you need a BankersLab Simulation Workshop or an InsightLab Business Case Simulation, we’ve taken it to a new level—with the help of AI.

Your Lending AI-Coach

After each simulation round, our AI-Coach steps in to analyze not just your financial results, but also your decision-making strategy.

Here are some of the ways AI has made the debrief richer than ever:

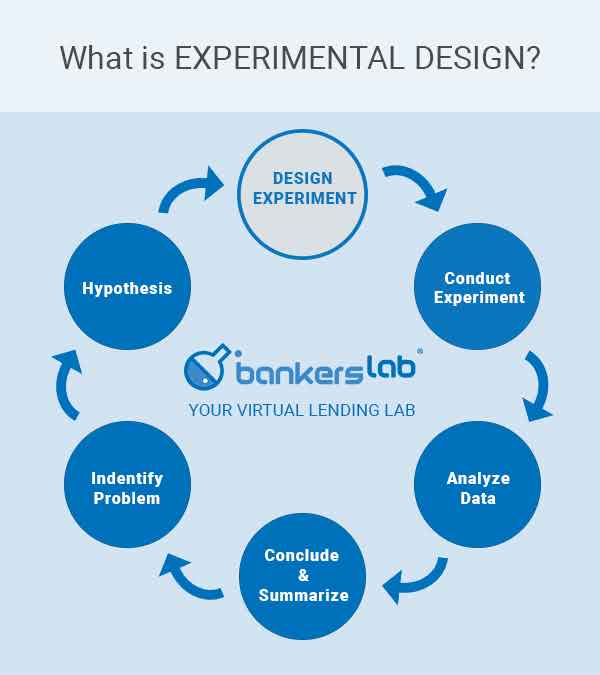

1. Experimental design (testing strategy).

In one workshop, Team Delta ran three different cut-off score tests side-by-side before settling on their final strategy. They tightened their application score by while adjusting verification. This allowed them to isolate which lever—score tightening or verification—had the bigger impact on cumulative net income (CNI). AI flagged their approach as the best experimental design, noting how they structured their tests like real-world A/B experiments.

By contrast, Team Omega changed multiple levers all at once (score, verification, pricing, and exposure), which made it difficult to tell which factor drove the outcome. The AI-Coach pointed this out, and the team immediately recognized the value of controlled testing.

2. Preparing for an economic downturn.

When the simulation shifted into a downturn scenario, the AI quickly identified which teams were best positioned. One group had been “pricing aggressively” while running very loose verification. This worked in the stable economy of Day 1, but when unemployment spiked, their delinquency ballooned. Another team, which had tested tighter bureau cut-offs and higher verification, came through the downturn with far lower charge-offs. The AI labeled them “most recession-ready”—and they won the final cumulative net income ranking.

3. Counterintuitive decisions.

Sometimes, teams make bold moves that seem risky but actually pay off. For example, one group decided to put only $100,000 of their $500,000 marketing budget into Personal Loans, funneling the rest into Credit Cards. Historically, teams assume a balanced spend is safest, but their gamble paid off: Credit Card response rates were stronger, and with disciplined underwriting, they booked more profitable accounts. The AI highlighted this as a counterintuitive but data-driven decision.

4. What you did well—and what you missed.

Every team hears not just their numbers, but also their behaviors. One group was praised for using verification thresholds strategically: they tested 40% vs. 60% and realized the incremental approvals at 40% weren’t worth the spike in defaults. Another team, however, never tested pricing changes at all. The AI-Coach noted that a simple 1% APR increase test might have revealed a sweet spot in balancing risk and revenue

Now Let’s Have Some Fun!

After the serious analysis, we lighten the mood with a GenAI comedy roast of each team. Expect lines like:

- “Team Alpha tightened verification to 80%. Sure, you avoided risk, but rumor has it your loan officers are now selling lemonade on the side just to book business.”

- “Team Beta spent $400K on Personal Loan marketing. The Personal Loan customers loved you—but your Credit Card team is filing for unemployment.”

It’s lighthearted, but it reinforces the lessons with a smile.

In All Seriousness…

We launched these enhancements in early 2025, and here’s what we’ve seen so far:

- Debriefs are richer. Teams don’t just look at who won, but why and how they won. AI surfaces patterns that often go unnoticed.

- Feedback is both analytical and behavioral. Teams hear where their numbers shined, but also where their approach to testing could be sharper.

Takeaways are practical. Every insight connects directly to real-world portfolio management: underwriting trade-offs, collections strategy, marketing allocation, and pricing discipline.

Join Us in 2026

Whether you’re looking to sharpen your lending acumen, test strategies in a safe environment, or just enjoy a few laughs at your team’s expense, our AI-powered simulations are the perfect blend of insight and fun.

See you in 2026—with sharper strategies, better testing, and maybe even a comedy roast you’ll never forget.