GUIDED TEAMS TO STRONGER,

DATA-DRIVEN OUTCOMERS

TEST THE FUTURE BEFORE IT HAPPENS

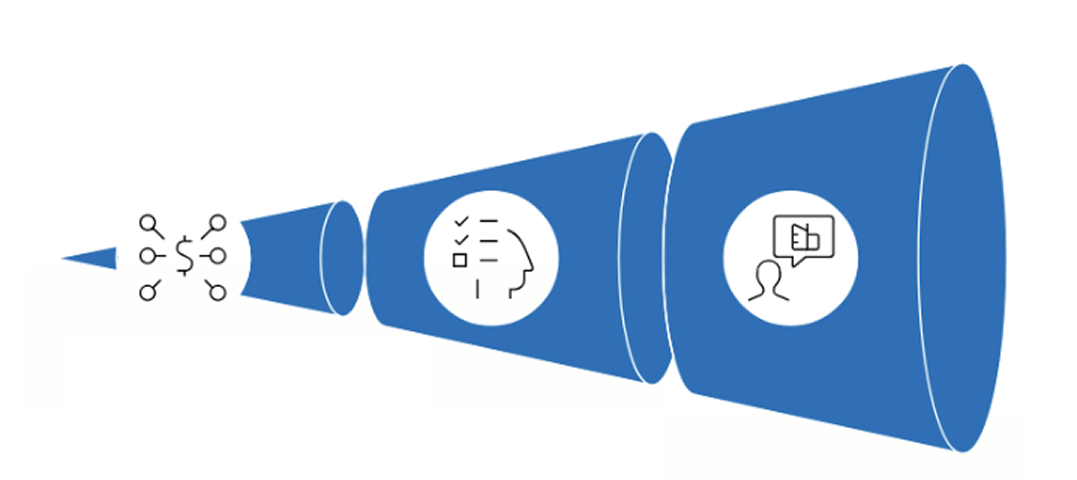

BankersLab’s Simulation provides a forward-looking view of your lending strategies. Transform decision making with simulation-powered AI—turning insights into action and strategy into performance at scale.