Congrats to everyone who participated in our UltraFICO® Simulation Challenge at FICO World 2023!

FICOWORLD

The UltraFICO® Simulation Challenge Recap

UltraFICO® Simulation Challenge

Congrats to everyone who participated in our UltraFICO® Simulation Challenge at FICO World 2023!

In the competition, teams experimented with the UltraFICO® Score in a “what-if” simulation, challenging their expertise and knowledge of open banking scores. Participants excelled in testing, improving, and applying their knowledge, while gaining years of accelerated portfolio management experience in an hour.

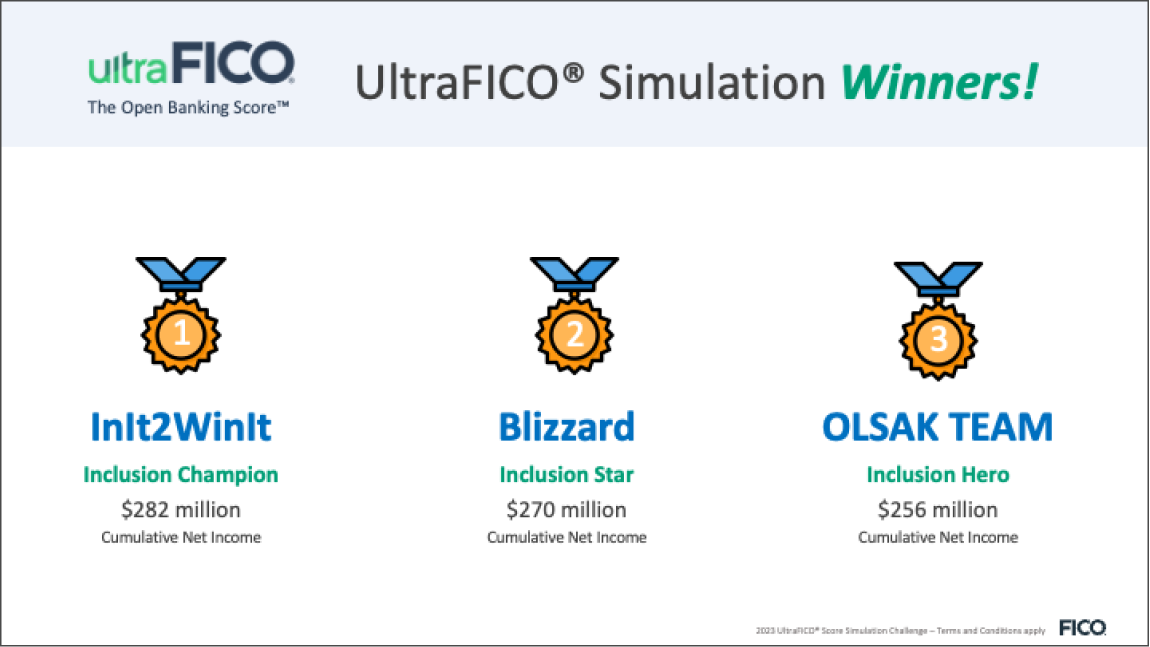

The winning teams of the UltraFICO Simulation Challenge

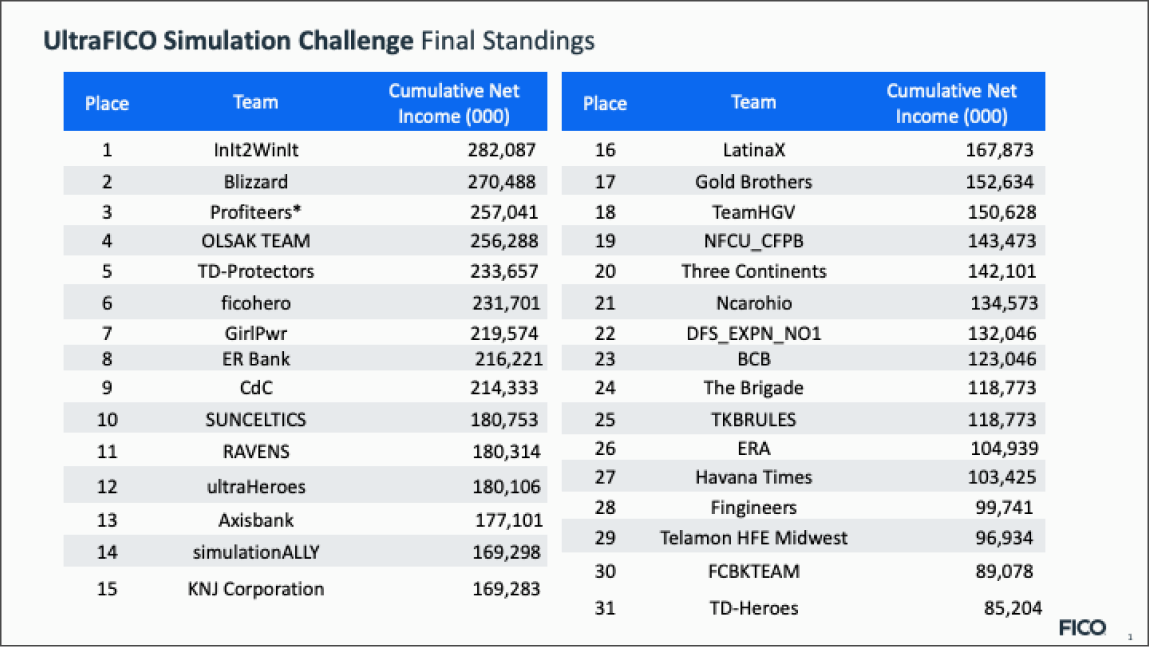

Our FICOWorld23 Teams

*Partner Company not eligible to win

What did teams accomplish in the simulation?

They put themselves in the shoes of a lender using the UltraFICO Score to approve applicants for their credit card and personal loan portfolios. First, they made an investment of $500,000 in their digital user experience. The goal of this investment was to educate and encourage borrowers to “unlock” the UltraFICO Score.

Why do borrowers need to ‘unlock’?

The UltraFICO score is achieved through a combination of the FICO Score, and data from their checking, saving and money market accounts (via Finicity).

Next, teams tested out their ideas about their underwriting criteria and loan terms. In three Trial runs they tested out different score cut-offs, pricing and loan amounts.

In the Final run, teams made portfolio decisions to get on the leaderboard.

The Outcome?

Every team was profitable in their use of the UltraFICO Score!

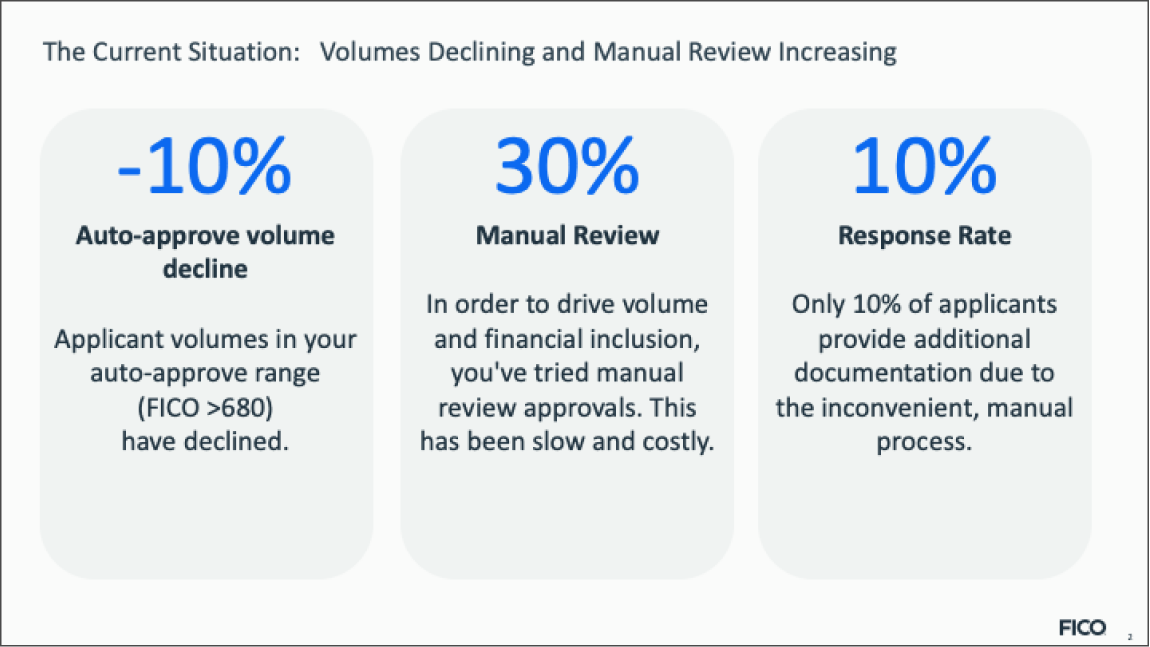

Scenario

Volumes Declining and Manual Review Increasing

An overview of the Scenario

Mission

Maximize Cumulative Net Income

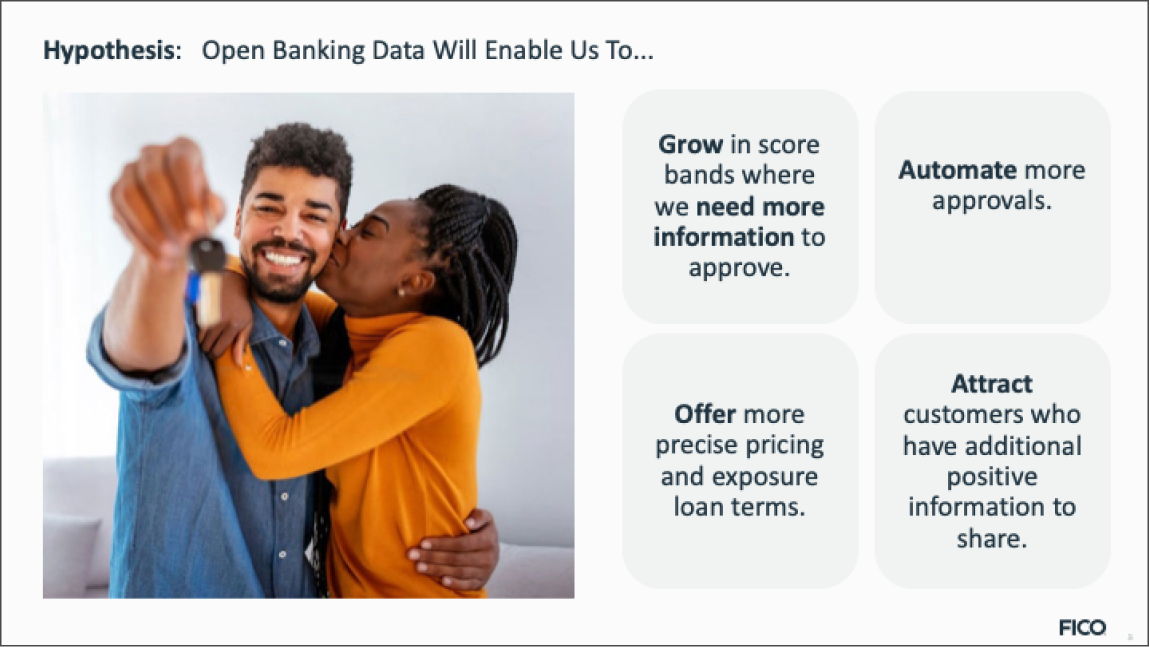

What can we do with Open Banking Data?

Interested in exploring Open Banking Data?

Ask us about our two day simulation workshop!